In its proprietary trading, Systematic Strategies primary focus in on equity and volatility strategies, both low and high frequency. In futures, the emphasis is on high frequency trading, although we also run one or two lower frequency strategies that have higher capacity, such as the Futures WealthBuilder. The version of WealthBuilder running on the Collective 2 site has performed very well in 2017, with net returns of 30% and a Sharpe Ratio of 3.4:

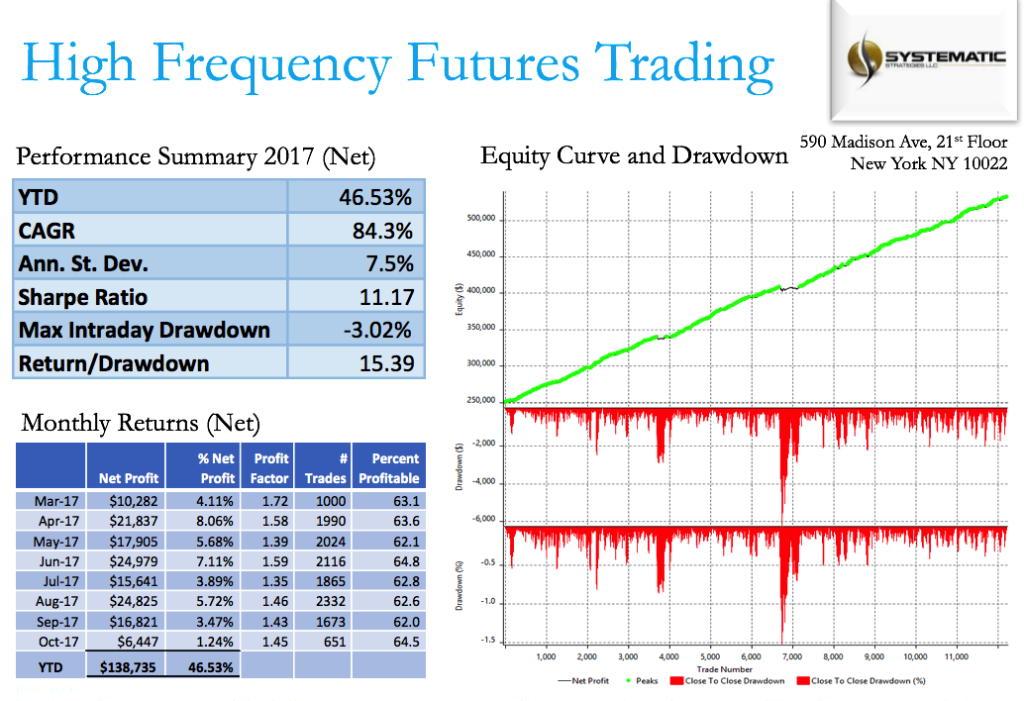

In the high frequency space, our focus is on strategies with very high Sharpe Ratios and low drawdowns. We trade a range of futures products, including equity, fixed income, metals and energy markets. Despite the current low levels of market volatility, these strategies have performed well in 2017:

Building high frequency strategies with double-digit Sharpe Ratios requires a synergy of computational capability and modeling know-how. The microstructure of futures markets is, of course, substantially different to that of equity or forex markets and the components of the model that include microstructure effects vary widely from one product to another. There can be substantial variations too in the way that time is handled in the model – whether as discrete or continuous “wall time”, in trade time, or some other measure. But some of the simple technical indicators we use – moving averages, for example – are common to many models across different products and markets. Machine learning plays a role in most of our trading strategies, including high frequency.

Here are some relevant blog posts that you may find interesting:

http://jonathankinlay.com/2016/04/high-frequency-trading-equities-vs-futures/

http://jonathankinlay.com/2015/05/designing-scalable-futures-strategy/

http://jonathankinlay.com/2014/10/day-trading-system-in-vix-futures/