We are launching a new product, the Futures WealthBuilder, a CTA system that trades futures contracts in several highly liquid financial and commodity markets, including SP500 EMinis, Euros, VIX, Gold, US Bonds, 10-year and five-year notes, Corn, Natural Gas and Crude Oil. Each component strategy uses a variety of machine learning algorithms to detect trends, seasonal effects and mean-reversion. We develop several different types of model for each market, and deploy them according to their suitability for current market conditions.

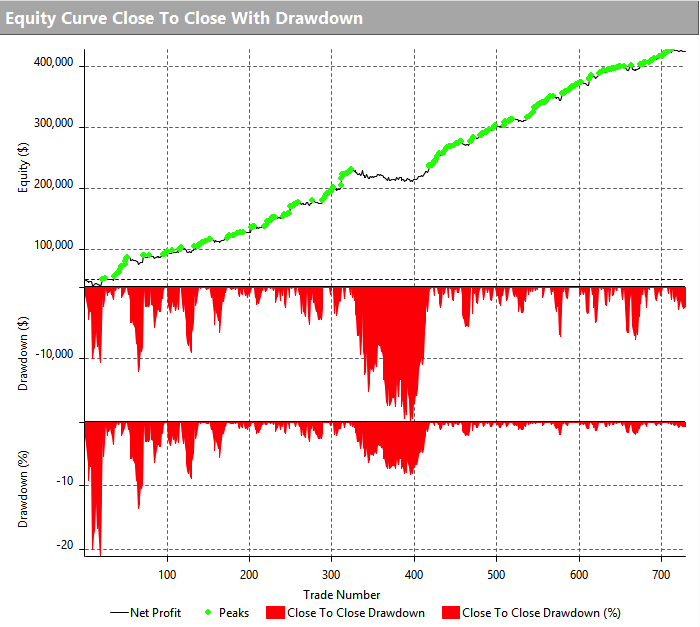

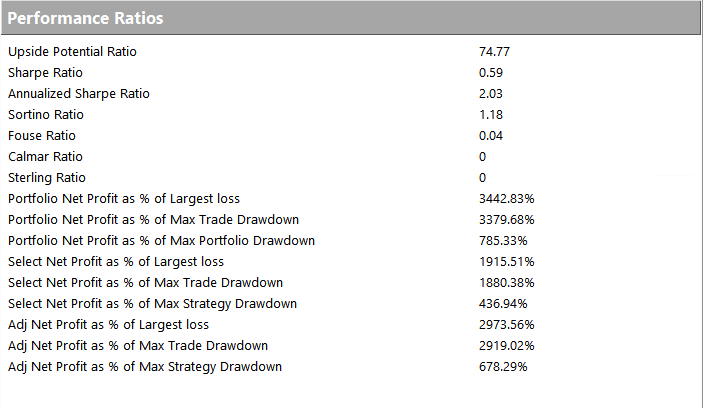

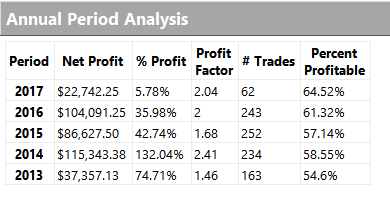

Performance of the strategy (net of fees) since 2013 is detailed in the charts and tables below. Notable features include a Sharpe Ratio of just over 2, an annual rate of return of 190% on an account size of $50,000, and a maximum drawdown of around 8% over the last three years. It is worth mentioning, too, that the strategy produces approximately equal rates of return on both long and short trades, with an overall profit factor above 2.

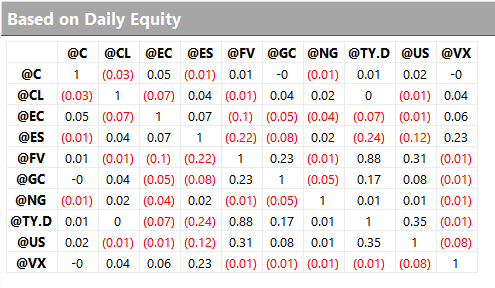

Low Correlation

Despite a high level of correlation between several of the underlying markets, the correlation between the component strategies of Futures WealthBuilder are, in the majority of cases, negligibly small (with a few exceptions, such as the high correlation between the 10-year and 5-year note strategies). This accounts for the relative high level of return in relation to portfolio risk, as measured by the Sharpe Ratio. We offer strategies in both products chiefly as a mean of providing additional liquidity, rather than for their diversification benefit.

Strategy Robustness

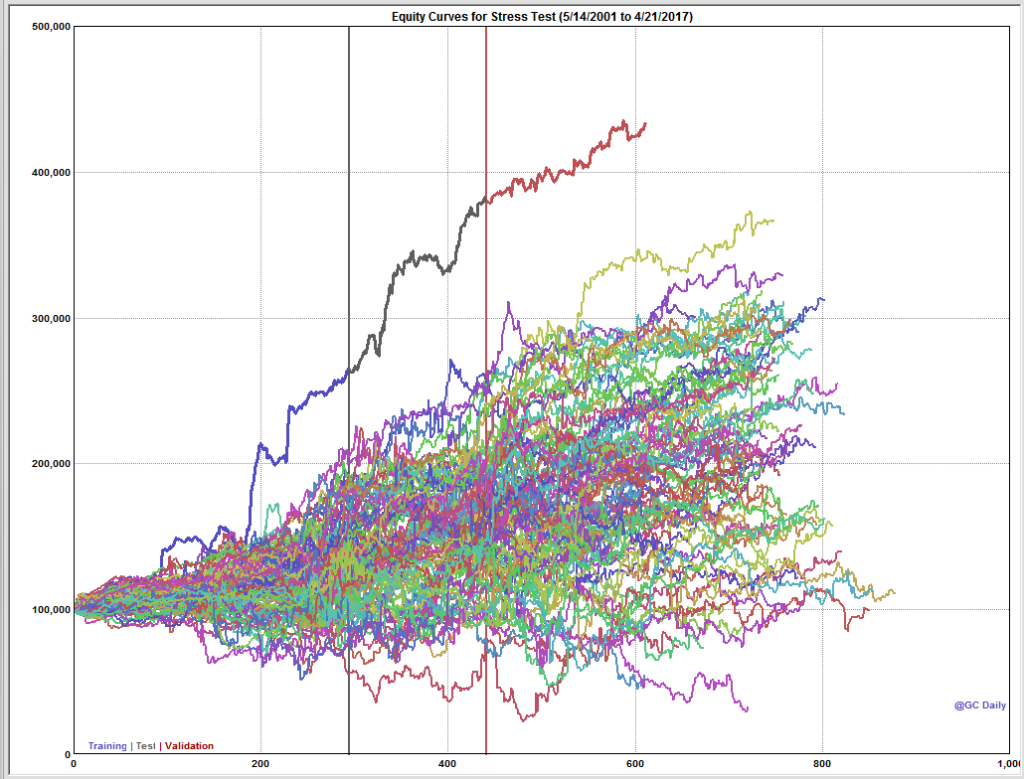

Strategy robustness is a key consideration in the design stage. We use Monte Carlo simulation to evaluate scenarios not seen in historical price data in order to ensure consistent performance across the widest possible range of market conditions. Our methodology introduces random fluctuations to historical prices, increasing or decreasing them by as much as 30%. We allow similar random fluctuations in that value strategy parameters, to ensure that our models perform consistently without being overly-sensitive to the specific parameter values we have specified. Finally, we allow the start date of each sub-system to vary randomly by up to a year.

The effect of these variations is to produce a wide range of outcomes in terms of strategy performance. We focus on the 5% worst outcomes, ranked by profitability, and select only those strategies whose performance is acceptable under these adverse scenarios. In this way we reduce the risk of overfitting the models while providing more realistic expectations of model performance going forward. This procedure also has the effect of reducing portfolio tail risk, and the maximum peak-to-valley drawdown likely to be produced by the strategy in future.

Futures WealthBuilder on Collective 2

We will be running a variant of the Futures WealthBuilder strategy on the Collective 2 site, using a subset of the strategy models in several futures markets(see this page for details). Subscribers will be able to link and auto-trade the strategy in their own account, assuming they make use of one of the approved brokerages which include Interactive Brokers, MB Trading and several others.

Obviously the performance is unlikely to be as good as the complete strategy, since several component sub-strategies will not be traded on Collective 2. However, this does give the subscriber the option to trial the strategy in simulation before plunging in with real money.