Jeff Swanson’s Trading System Success web site is often worth a visit for those looking for new trading ideas.

A recent post Seasonality S&P Market Session caught my eye, having investigated several ideas for overnight trading in the E-minis. Seasonal effects are of course widely recognized and traded in commodities markets, but they can also apply to financial products such as the E-mini. Jeff’s point about session times is well-made: it is often worthwhile to look at the behavior of an asset, not only in different time frames, but also during different periods of the trading day, day of the week, or month of the year.

Jeff breaks the E-mini trading session into several basic sub-sessions:

- “Pre-Market” Between 530 and 830

- “Open” Between 830 and 900

- “Morning” Between 900 though 1130

- “Lunch” Between 1130 and 1315

- “Afternoon” Between 1315 and 1400

- “Close” Between 1400 and 1515

- “Post-Market” Between 1515 and 1800

- “Night” Between 1800 and 530

In his analysis Jeff’s strategy is simply to buy at the open of the session and close that trade at the conclusion of the session. This mirrors the traditional seasonality study where a trade is opened at the beginning of the season and closed several months later when the season comes to an end.

Evaluating Overnight Session and Seasonal Effects

The analysis evaluates the performance of this basic strategy during the “bullish season”, from Nov-May, when the equity markets traditionally make the majority of their annual gains, compared to the outcome during the “bearish season” from Jun-Oct.

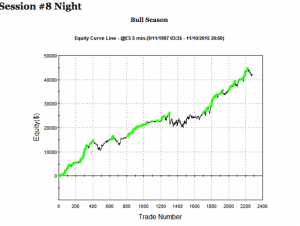

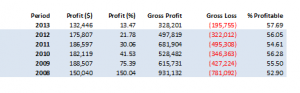

None of the outcomes of these tests is especially noteworthy, save one: the performance during the overnight session in the bullish season:

The tendency of the overnight session in the E-mini to produce clearer trends and trading signals has been well documented. Plausible explanations for this phenomenon are that:

(a) The returns process in the overnight session is less contaminated with noise, which primarily results from trading activity; and/or

(b) The relatively poor liquidity of the overnight session allows participants to push the market in one direction more easily.

Either way, there is no denying that this study and several other, similar studies appear to demonstrate interesting trading opportunities in the overnight market.

That is, until trading costs are considered. Results for the trading strategy from Nov 1997-Nov 2015 show a gain of $54,575, but an average trade of only just over $20:

|

Gross PL |

# Trades |

Av Trade |

|

$54,575 |

2701 |

$20.21 |

Assuming that we enter and exit aggressively, buying at the market at the start of the session and selling MOC at the close, we will pay the bid-offer spread and commissions amounting to around $30, producing a net loss of $10 per trade.

The situation can be improved by omitting January from the “bullish season”, but the slightly higher average trade is still insufficient to overcome trading costs :

|

Gross PL |

# Trades |

Av Trade |

|

$54,550 |

2327 |

$23.44 |

Designing a Seasonal Trading Strategy for the Overnight Session

At this point an academic research paper might conclude that the apparently anomalous trading profits are subsumed within the bid-offer spread. But for a trading system designer this is not the end of the story.

If the profits are insufficient to overcome trading frictions when we cross the spread on entry and exit, what about a trading strategy that permits market orders on only the exit leg of the trade, while using limit orders to enter? Total trading costs will be reduced to something closer to $17.50 per round turn, leaving a net profit of almost $6 per trade.

Of course, there is no guarantee that we will successfully enter every trade – our limit orders may not be filled at the bid price and, indeed, we are likely to suffer adverse selection – i.e. getting filled on every losing trading, while missing a proportion of the winning trades.

On the other hand, we are hardly obliged to hold a position for the entire overnight session. Nor are we obliged to exit every trade MOC – we might find opportunities to exit prior to the end of the session, using limit orders to achieve a profit target or cap a trading loss. In such a system, some proportion of the trades will use limit orders on both entry and exit, reducing trading costs for those trades to around $5 per round turn.

The key point is that we can use the seasonal effects detected in the overnight session as a starting point for the development for a more sophisticated trading system that uses a variety of entry and exit criteria, and order types.

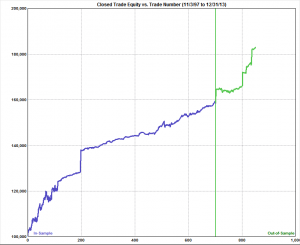

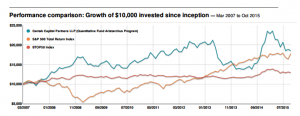

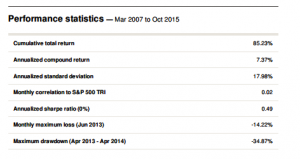

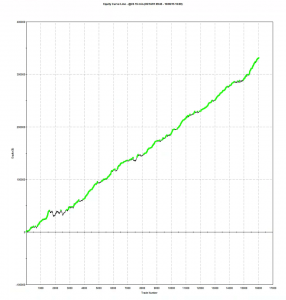

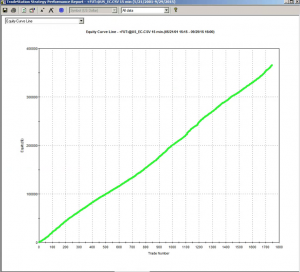

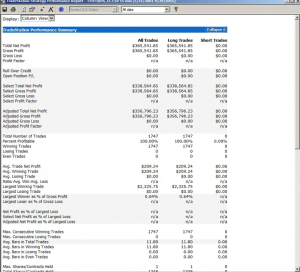

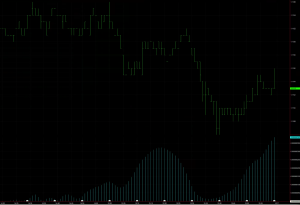

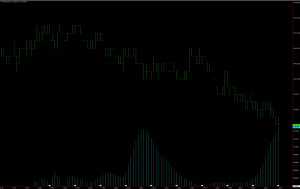

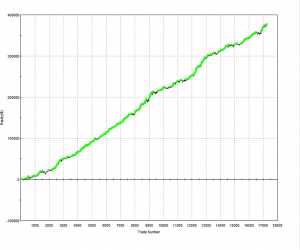

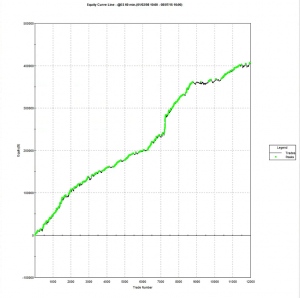

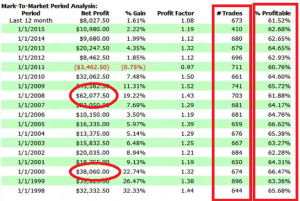

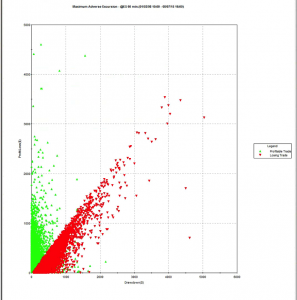

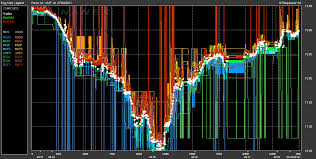

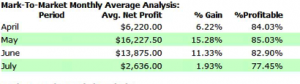

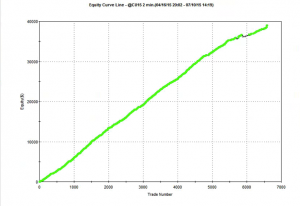

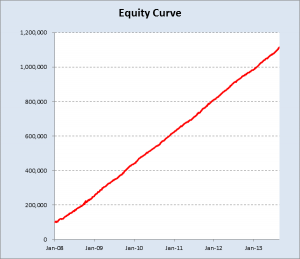

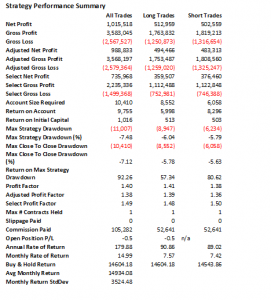

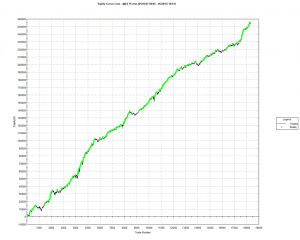

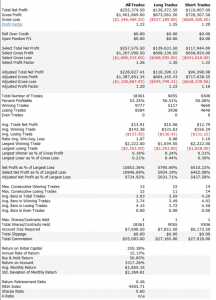

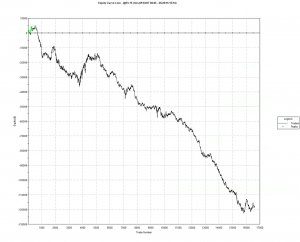

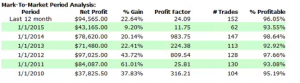

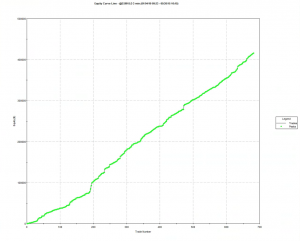

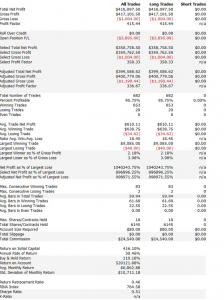

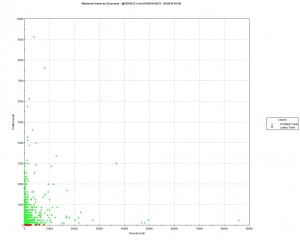

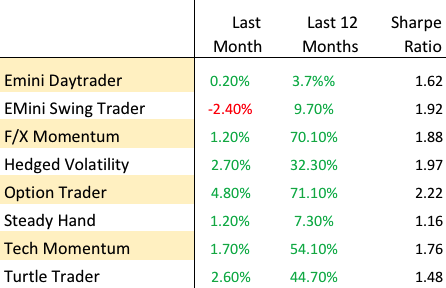

The following shows the performance results for a trading system designed to trade 30-minute bars in the E-mini futures overnight session during the months of Nov to May.The strategy enters trades using limit prices and exits using a combination of profit targets, stop loss targets, and MOC orders.

Data from 1997 to 2010 were used to design the system, which was tested on out-of-sample data from 2011 to 2013. Unseen data from Jan 2014 to Nov 2015 were used to provide a further (double blind) evaluation period for the strategy.

|

|

ALL TRADES |

LONG |

SHORT |

|

Closed Trade Net Profit |

$83,080 |

$61,493 |

$21,588 |

|

Gross Profit |

$158,193 |

$132,573 |

$25,620 |

|

Gross Loss |

-$75,113 |

-$71,080 |

-$4,033 |

|

Profit Factor |

2.11 |

1.87 |

6.35 |

|

Ratio L/S Net Profit |

2.85 |

||

|

Total Net Profit |

$83,080 |

$61,493 |

$21,588 |

|

Trading Period |

11/13/97 2:30:00 AM to 12/31/13 6:30:00 AM (16 years 48 days) |

||

|

Number of Trading Days |

2767 |

||

|

Starting Account Equity |

$100,000 |

||

|

Highest Equity |

$183,080 |

||

|

Lowest Equity |

$97,550 |

||

|

Final Closed Trade Equity |

$183,080 |

||

|

Return on Starting Equity |

83.08% |

||

|

Number of Closed Trades |

849 |

789 |

60 |

|

Number of Winning Trades |

564 |

528 |

36 |

|

Number of Losing Trades |

285 |

261 |

24 |

|

Trades Not Taken |

0 |

0 |

0 |

|

Percent Profitable |

66.43% |

66.92% |

60.00% |

|

Trades Per Year |

52.63 |

48.91 |

3.72 |

|

Trades Per Month |

4.39 |

4.08 |

0.31 |

|

Max Position Size |

1 |

1 |

1 |

|

Average Trade (Expectation) |

$97.86 |

$77.94 |

$359.79 |

|

Average Trade (%) |

0.07% |

0.06% |

0.33% |

|

Trade Standard Deviation |

$641.97 |

$552.56 |

$1,330.60 |

|

Trade Standard Deviation (%) |

0.48% |

0.44% |

1.20% |

|

Average Bars in Trades |

15.2 |

14.53 |

24.1 |

|

Average MAE |

$190.34 |

$181.83 |

$302.29 |

|

Average MAE (%) |

0.14% |

0.15% |

0.27% |

|

Maximum MAE |

$3,237 |

$2,850 |

$3,237 |

|

Maximum MAE (%) |

2.77% |

2.52% |

3.10% |

|

Win/Loss Ratio |

1.06 |

0.92 |

4.24 |

|

Win/Loss Ratio (%) |

2.10 |

1.83 |

7.04 |

|

Return/Drawdown Ratio |

15.36 |

14.82 |

5.86 |

|

Sharpe Ratio |

0.43 |

0.46 |

0.52 |

|

Sortino Ratio |

1.61 |

1.69 |

6.40 |

|

MAR Ratio |

0.71 |

0.73 |

0.33 |

|

Correlation Coefficient |

0.95 |

0.96 |

0.719 |

|

Statistical Significance |

100% |

100% |

97.78% |

|

Average Risk |

$1,099 |

$1,182 |

$0.00 |

|

Average Risk (%) |

0.78% |

0.95% |

0.00% |

|

Average R-Multiple (Expectancy) |

0.0615 |

0.0662 |

0 |

|

R-Multiple Standard Deviation |

0.4357 |

0.4357 |

0 |

|

Average Leverage |

0.399 |

0.451 |

0.463 |

|

Maximum Leverage |

0.685 |

0.694 |

0.714 |

|

Risk of Ruin |

0.00% |

0.00% |

0.00% |

|

Kelly f |

34.89% |

31.04% |

50.56% |

|

Average Annual Profit/Loss |

$5,150 |

$3,811 |

$1,338 |

|

Ave Annual Compounded Return |

3.82% |

3.02% |

1.22% |

|

Average Monthly Profit/Loss |

$429.17 |

$317.66 |

$111.52 |

|

Ave Monthly Compounded Return |

0.31% |

0.25% |

0.10% |

|

Average Weekly Profit/Loss |

$98.70 |

$73.05 |

$25.65 |

|

Ave Weekly Compounded Return |

0.07% |

0.06% |

0.02% |

|

Average Daily Profit/Loss |

$30.03 |

$22.22 |

$7.80 |

|

Ave Daily Compounded Return |

0.02% |

0.02% |

0.01% |

|

INTRA-BAR EQUITY DRAWDOWNS |

ALL TRADES |

LONG |

SHORT |

|

Number of Drawdowns |

445 |

422 |

79 |

|

Average Drawdown |

$282.88 |

$269.15 |

$441.23 |

|

Average Drawdown (%) |

0.21% |

0.20% |

0.33% |

|

Average Length of Drawdowns |

10 days 19 hours |

10 days 20 hours |

66 days 1 hours |

|

Average Trades in Drawdowns |

3 |

3 |

1 |

|

Worst Case Drawdown |

$6,502 |

$4,987 |

$4,350 |

|

Date at Trough |

12/13/00 1:30 |

5/24/00 4:30 |

12/13/00 1:30 |