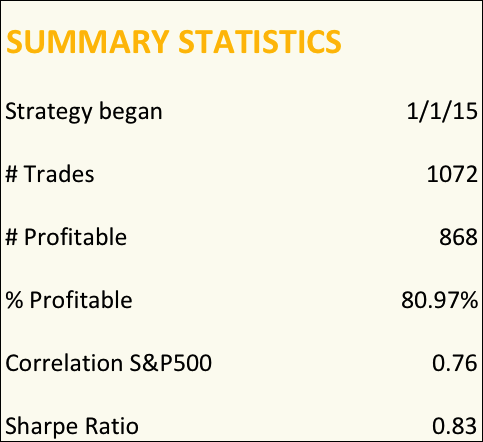

The Long-Short Stock Trader strategy uses a quantitative model to introduce market orders, both entry and exits. The model looks for divergencies between stock price and its current volatility, closing the position when the Price-volatility gap is closed. The strategy is designed to obtain a better return on risk than S&P500 index and the risk management is focused on obtaining a lower drawdown and volatility than index.

The model trades only Large Cap stocks, with high liquidity and without scalability problems. Thanks to the high liquidity, market orders are filled without market impact and at the best market prices.

For more information and back-test results go here.

The Long-Short Trader is the first strategy launched on the Systematic Algotrading Platform under our new Strategy Manager Program.

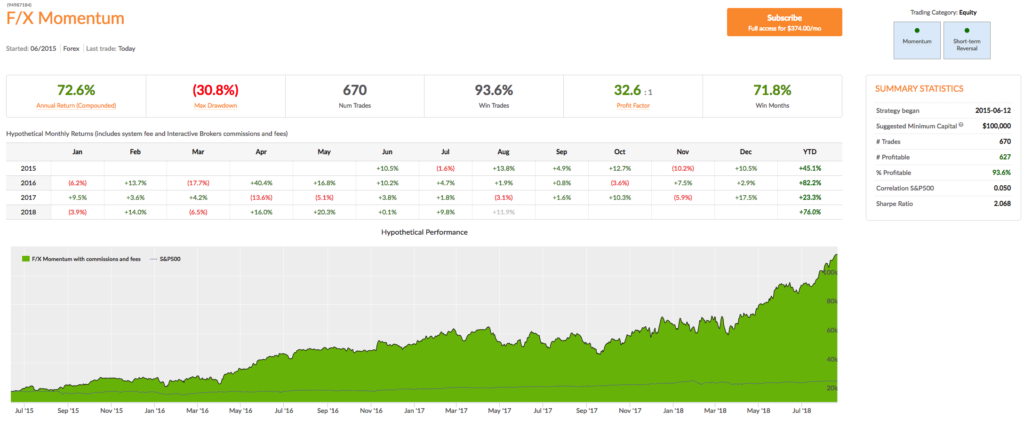

Performance Summary

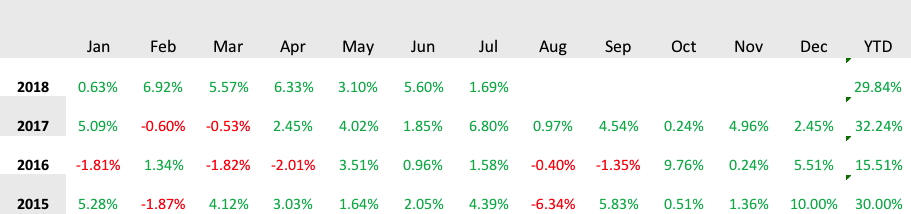

Monthly Returns

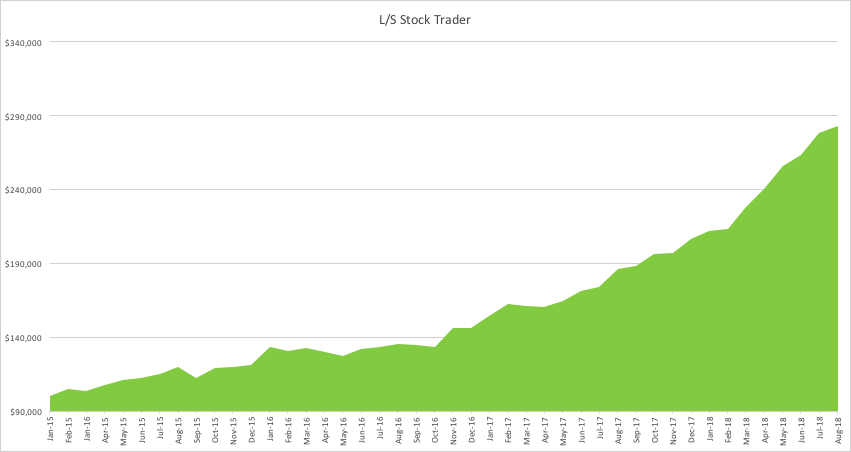

Value of $100,000 Portfolio