I apologize in advance for this rather “wonkish” post, which is aimed chiefly at the high frequency fraternity, or those at least who trade intra-day, in the equity markets. Such minutiae are the lot of those engaged in high frequency trading. I promise that my next post will be of more general interest.

Pre- and Post Market Sessions

The pre-market session in US equities runs from 8:00 AM ET, while the post-market session runs until 8:00 PM ET. The question arises whether these sessions are worth trading, or at the very least, offer a source of data (quotes, trades) that might be relevant to trading the regular session, which of course runs from 9:30 AM to 4:00 PM ET. Even if liquidity is thin and trades infrequent, and opportunities in the pre- and post-market very limited, it might be that we can improve our trading models by taking into account such information as these sessions do provide, even if we only ever plan to trade during regular trading hours.

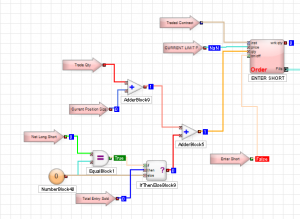

It is somewhat challenging to discuss this in great detail, because HFT equity trading is very much in the core competencies of my firm, Systematic Strategies. However, I hope to offer some ideas, at least, that some readers may find useful.

A Tale of Two Pharmaceutical Stocks

In what follows I am going to make use of two examples from the pharmaceutical industry: Alexion Pharmaceuticals, Inc. (ALXN), which has a market cap of $35Bn and trades around 800,000 shares daily, and Pfizer Inc. (PFE), which has a market cap of over $200Bn and trades close to 50M shares a day.

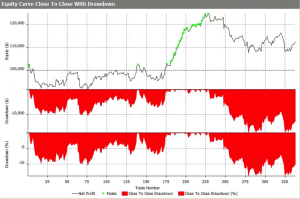

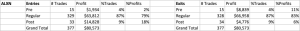

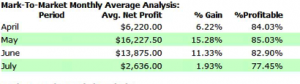

Let’s start by looking at a system trading ALXN during regular market hours. The system isn’t high frequency, but trades around 1-2 times a day, on average. The strategy equity curve from 2015 to April 2016 is not at all impressive.

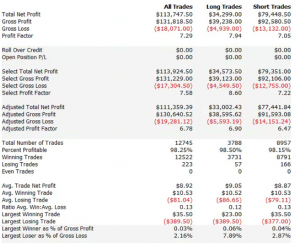

ALXN – Regular Session Only

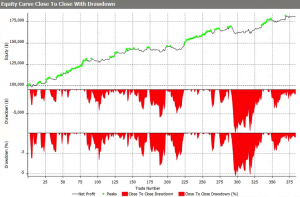

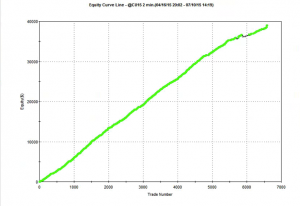

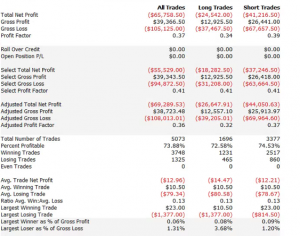

But look at the equity curve for the same strategy when we allow it to run on the pre- and post-market sessions, in addition to regular trading hours. Clearly the change in the trading hours utilized by the strategy has made a huge improvement in the total gain and risk-adjusted returns.

ALXN – with Pre- and Post-Market Sessions

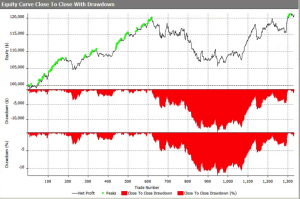

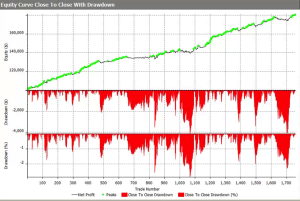

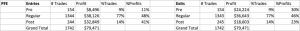

The PFE system trades much more frequently, around 4 times a day, but the story is somewhat similar in terms of how including the pre- and post-market sessions appears to improve its performance.

PFE – Regular Session Only

PFE – with Pre- and Post-Market Sessions

Improving Trading Performance

In both cases, clearly, the trading performance of the strategies has improved significantly with the inclusion of the out-of-hours sessions. In the case of ALXN, we see a modest increase of around 10% in the total number of trades, but in the case of PFE the increase in trading activity is much more marked – around 30%, or more.

The first important question to ask is when these additional trades are occurring. Assuming that most of them take place during the pre- or post-market, our concern might be whether there is likely to be sufficient liquidity to facilitate trades of the frequency and size we wish to execute. Of various possible hypotheses, some negative, other positive, we might consider the following:

(a) Bad ticks in the market data feed during out-of-hours sessions give rise to apparently highly profitable “phantom” trades

(b) The market data is valid, but the trades are done in such low volume as to be insignificant for practical purposes (i.e. trades were done for a few hundred lots and additional liquidity is unlikely to be available)

(c) Out-of-hours sessions enable the system to improve profitability by entering or exiting positions in a more timely manner than by trading the regular session alone

(d) Out-of-hours market data improves the accuracy of model forecasts, facilitating a larger number of trades, and/or more profitable trades, during regular market hours

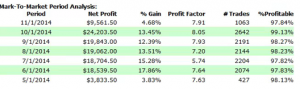

An analysis of the trading activity for the two systems provides important insight as to which of the possible explanations might be correct.

(click to enlarge)

Dealing first with ALXN, we that, indeed, an additional 11% of trades are entered or exited out-of-hours. However, these additional trades account for somewhere between 17% (on exit) and 20% (on entry) of the total profits. Furthermore, the size of the average entry trade during the post-market session and of the average exit trade in the pre-market session is more than double that of the average trade entered or exited during regular market hours. That gives concerns that some of the apparent increase in profits may be due to bad ticks at prices away from the market, allowing the system enter or exit trades at unrealistically low or high prices. Even if many of the trades are good, we will have concerns about the scalability of the strategy in out-of-hours trading, given the relatively poor liquidity in the stock. On the other hand, at least some of the uplift in profits arises from new trades occurring during the regular session. This suggests that, even if we are unable to execute many of the trading opportunities seen during pre- or post-market, the trades from those sessions provides useful additional data points for our model, enabling it to increase the number and/or profitability of trades in the regular session.

Next we turn to PFE. We can see straight away that, while the proportion of trades occurring during out-of-hours sessions is around 23%, those trades now account for over 50% of the total profits. Furthermore, the average PL for trades executed on entry post-market, and on exit pre-market, is more than 4x the average for trades entered or exited during normal market hours. Despite the much better liquidity in PFE compared to ALXN, this is a huge concern – we might expect to see significant discrepancies occurring between theoretical and actual performance of the strategy, due to the very high dependency on out-of-hours trading.

(click to enlarge)

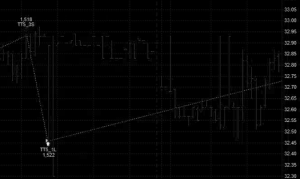

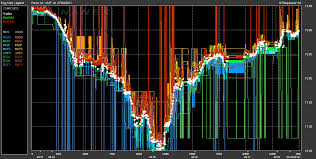

As we dig further into the analysis, we do indeed find evidence that bad data ticks play a disproportionate role. For example, this trade in PFE which apparently occurred at around 16:10 on 4/6 was almost certainly a phantom trade resulting from a bad data point. It turns out that, for whatever reason, such bad ticks are a common occurrence in the stock and account for a large proportion of the apparent profitability of out-of-hours trading in PFE.

CONCLUSION

We are, of course, only skimming the surface of the analysis that is typically carried out. One would want to dig more deeply into ways in which the market data feed could be cleaned up and bad data ticks filtered out so as to generate fewer phantom trades. One would also want to look at liquidity across the various venues where the stocks trade, including dark pools, in order to appraise the scalability of the strategies.

For now, the main message that I am seeking to communicate is that it is often well worthwhile considering trading in the pre- and post-market sessions, not only with a view to generating additional, profitable trading opportunities, but also to gather additional data points that can enhance trading profitability during regular market hours.