This algorithm builds on the research by Stoikova and Avelleneda in their 2009 paper “High Frequency Trading in a Limit Order Book“, 2009 and extends the basic algorithm in several ways:

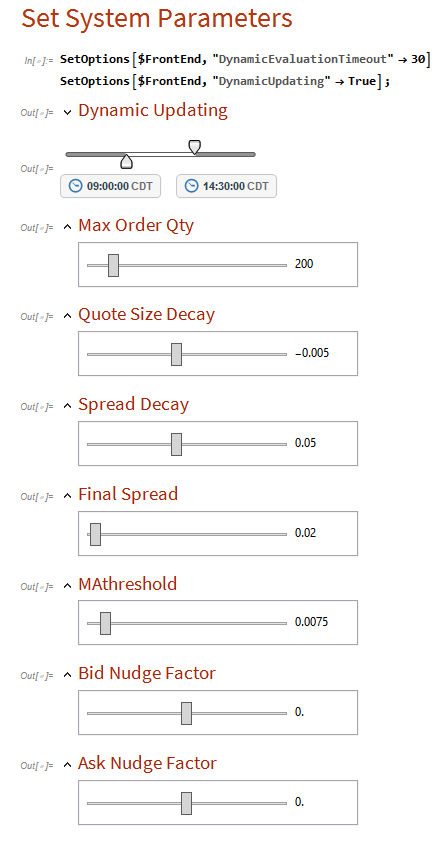

- The algorithm makes two sided markets in a specified list of equities, with model parameters set at levels appropriate for each product.

- The algorithm introduces an automatic mechanism for managing inventory, reducing the risk of adverse selection by changing the rate of inventory accumulation dynamically.

- The algorithm dynamically adjusts the range of the bid-ask spread as the trading session progresses, with the aim of minimizing inventory levels on market close.

- The extended algorithm makes use of estimates of recent market trends and adjusts the bid-offer spread to lean in the direction of the trend.

- A manual adjustment factor allows the market-maker to nudge the algorithm in the direction of reducing inventory.

The algorithm is implemented in Mathematica, and can be compiled to create dlls callable from with a C++ or Python application.

The application makes use of the MATH-TWS library to connect to the Interactive Brokers TWS or Gateway platform via the C++ api. MATH-TWS is used to create orders, manage positions and track account balances & P&L.